The rules and tariffs on importing and exporting goods have changed thanks to Brexit. As a buyer or a seller, you need to be aware so that you don't find yourself with an unexpected bill or an unhappy customer.

We received this letter from an NHS Trust recently. To be clear, it doesn't apply to anything they've bought from us, but so widespread is this problem they felt the need to alert all suppliers.

"Dear Supplier,

We have recently received a large number of invoices for the importation of goods from several couriers, but particularly DHL and UPS. Please can you ensure that the courier companies you use, are aware that it is you, as the supplier, that should be invoiced for these charges. The Trust will only pay costs as agreed at the time the Purchase Order, and therefore, contract was made.

Please be aware that should invoices be presented with your goods, to the Trust, the Trust will not make payment and will refuse the goods should the courier not agree to leave the items without payment of the import charges. This will, in turn, mean that you as a supplier, will also not be paid for the items ordered, as they won’t have been successfully delivered to the Trust."

As far as we understand it*, and it is VERY confusing, if a company/NHS Trust receives goods from outside the UK they become the 'importer' and therefore must pay import duty either via the courier or to HMRC directly.

How can I tell if I need to pay import duty?

A telltale sign is no VAT on the quote. Unless your purchase qualifies for zero-rating, VAT will always need to be paid. If the company you're buying from is shipping goods from outside the UK directly to you, technically they are not importing it, you are, so they don't need to charge VAT. However, you will still need to pay it.

How can you protect yourself from unexpected import charges?

- Always check your quote includes VAT.

- Always ask where goods are coming from.

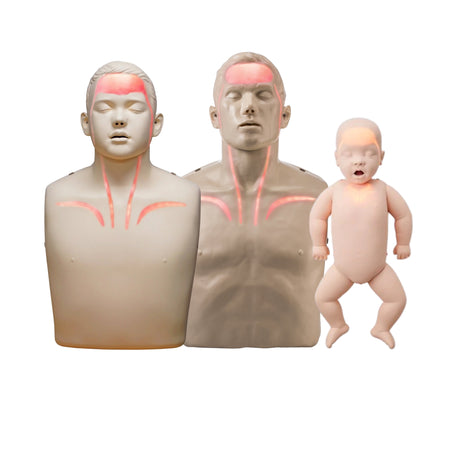

- Buy from Sim & Skills! Slightly tongue-in-cheek but we do our best to follow the rules, despite them not being easy to understand. The vast majority of our products are imported into the UK before they reach our customers, and if they're not, we make it explicitly clear so you can buy with confidence.

The latest guidance from Gov.uk:VATVAT is charged on all goods (except for gifts worth £39 or less) sent from:

VAT is not charged on goods that are gifts worth £39 or less. You pay VAT when you buy the goods or to the delivery company before you receive them. If you have to pay VAT to the delivery company, it’s charged on the total package value, including:

VAT is charged at the VAT rate that applies to your goods. Goods worth £135 or less in totalIf you bought the goods yourself and they are not excise goods, the seller will have included VAT in the total you paid. You will need to pay VAT to the delivery company if the goods are:

Goods worth more than £135 in totalYou will have to pay VAT to the delivery company either before the goods are delivered or when you collect them. |

We believe there are plans to make the importing and exporting of goods more straightforward with new legislation in July 2021. Subscribe for an update when we know more.